Rate of Return RoR: Meaning, Formula, and Examples

The next step in understanding RoR over time is to account for the time value of money (TVM), which the CAGR ignores. Discounted cash flows take the earnings of an investment and discount each of the cash flows based on a discount rate. The discount rate represents a minimum rate of return acceptable to the investor, or an assumed rate of inflation. In addition to investors, businesses use discounted cash flows to assess the profitability of their investments.

- However, the formula does not consider the cash flows of an investment or project or the overall timeline of return, which determines the entire value of an investment or project.

- If your simple rate of return clears the minimum by at least a few points, there’s a good chance it’s worth more serious consideration.

- But the simple rate of return formula counts all income the same, whether it’s earned tomorrow or ten years from now.

- In addition, neither ROI nor ROE takes TVM (which you can read more about in our time value of money calculator) into account.

- The study concluded that investors could withdraw 4% of their investment portfolios each year (adjusted for inflation) with a ~95% chance of not running out of money.

Recommended Finance Resources

Personally, I will plan for and start at a withdrawal rate of 3.5%, then adjust as I go. If you can accept a lower survival rate and are willing to be flexible if the need arises, you may be able to use a withdrawal rate of 4% or more. If this what is an invoice what is it used for number equates to 2.5%, you’ll know you can cut back significantly if needed in the case of a market downturn, high inflation, or some unpredictable “Black Swan” event. This gives you the flexibility for when you need to preserve capital.

Ask a Financial Professional Any Question

On the other hand, consider an investor that pays $1,000 for a $1,000 par value 5% coupon bond. The average annual rate of return for the total stock market between 2013 and 2023, as measured by the growth of the S&P 500 index. Note that actual returns vary widely from year to year, and from stock to stock. Your friend’s initial investment is $40,000 dollars with a zero final amount received but 5,000 dollars in withdrawals for 10 years.

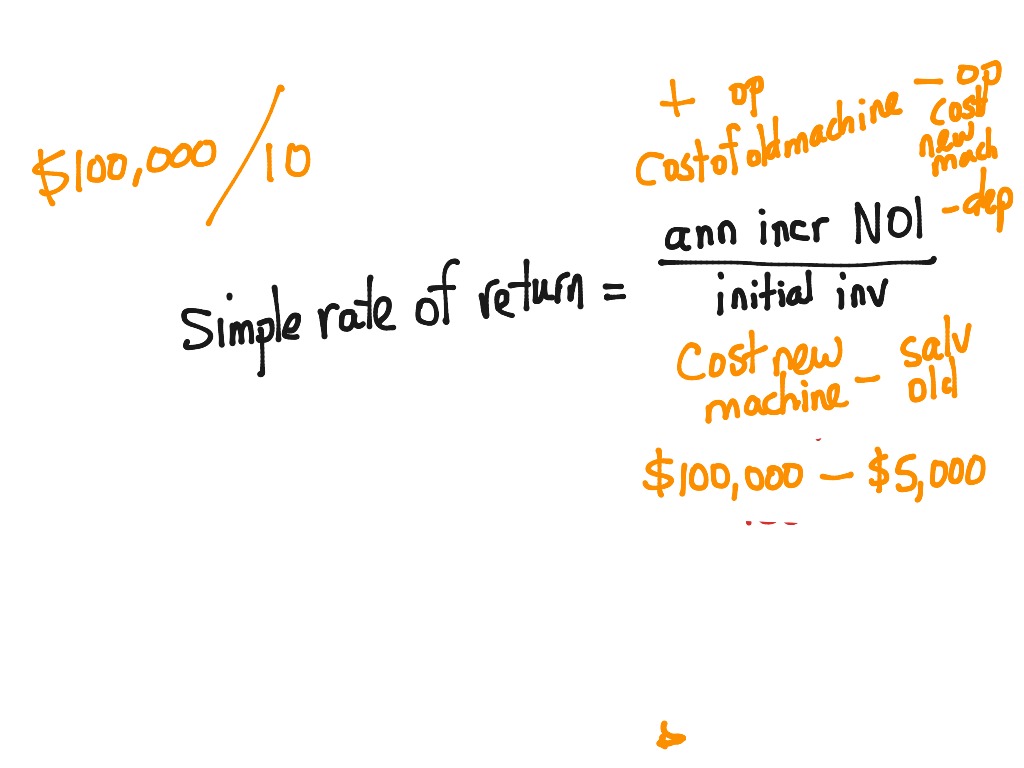

What is the Formula to Calculate the Rate of Return Formula?

When periodic rates of return vary from period to period, the geometric mean return will always be lower than the arithmetic mean return. The ROI Calculator includes an Investment Time input to hurdle this weakness by using something called the annualized ROI, which is a rate normally more meaningful for comparison. The stitcher will still add the $40,000 to revenues, but will add $10,000 to annual operating costs and only have a useful life of three years. The rate of return helps investors determine if a potential investment is going to be beneficial to them or not. However, if the amount is negative, it will fail to yield a 10% rate of return, and the business would be better off looking for a more profitable investment. The ROI calculator will calculate this answer as well, and it will also calculate the annualized ROI, which is the same as the rate of return.

If a project has an initial investment of $1,000 and earns a 10% internal rate of return for 5 years, it is equivalent to earning 10% over 5 years. The company can use this to determine if an investment makes sense or not. If the sum of all the discounted cash flows (including the cost of the initial investment) is greater than $0, the company should move forward with the project. The ROR can be positive or negative and can be calculated on any type of asset as long as there is a beginning and ending value and a time period. You can use the rate of return calculator above to calculate ROR if there are no cash flows during the time period.

What Is the Average Stock Market Return?

Our return on investment calculator can also be used to compare the efficiency of a few investments. Thus, you will find the ROI formula helpful when you are going to make a financial decision. If you know how to calculate ROI, it’s easier to foresee the results of an investment.

In other words, ROR is the percentage of loss or income compared to the initial amount invested. The rate of return allows investors to assess the success or failure of an investment by quantifying the percentage gain or loss over a specific period. It provides a standardized metric for comparison across different investments or asset classes.

Annualized rate of return (Ra) standardizes your rate of return on an annual basis; this allows you to make fair comparisons with other annualized performance figures. If done correctly, the formula should calculate a one year rate of return of 20%, based on the beginning and end of period values provided. After one year, the value of the investment rises to $150 and the investor chooses to sell it. Given that $150 represents the value of the investment at the end of the holding period, $150 will be your end of period value (“Ve”).

댓글을 남겨주세요

Want to join the discussion?Feel free to contribute!